The Surprising Benefits of Payment Plans

There’s nothing more worrisome to a small firm than cash flow, but making sure your clients pay can be problematic. Why? Clients have cash flow concerns, too. Paying hundreds or thousands of dollars out-of-pocket is not something many people can afford in today’s economy. So how do you bridge the gap between your client’s needs and yours?

Payment plans.

A payment plan is one of the best ways to collect revenues. With payment plans, lawyers can set an amount for an invoice and charge clients on a monthly basis until the balance is paid off. This is perfect for times when a client cannot pay large bills upfront but can pay in increments, which is commonly the case with Immigration attorneys, Criminal Defense attorneys, or any litigators who generate large bills.

However, there are other benefits to using payment plans. Here are just a few:

They’re relationship builders.

As your clients’ legal representative, you’re likely very aware of their finances. By offering a payment plan or accommodating one when asked, you’re essentially telling your clients that you’re a compassionate person. While some in the industry might disagree, there is still a place for empathy in the law. I’m not saying you and your staff should spend hours on the phone hearing a client’s sob story about why they can’t pay, but it is good to approach a client who is 30, 60, or even 90 days late paying with a solution to pay you in installments. It’s also good for business because it’ll keep that client coming back. You might even get a glowing review on Google and some referrals. In other words, that client will always remember the attorney who was flexible and showed some understanding of their financial situation.

Payment plans can help you avoid collections court.

If your client is one for excuses and false promises (or even worse, files for bankruptcy), your only option may seem to be to file suit to make sure you have a claim to your hard-earned fees. Unfortunately, resorting to litigation to recover fees still means you’re losing time and money. However, if your client commits to an automatic payment plan upfront, you might be able to avoid court altogether.

You can set-and-forget.

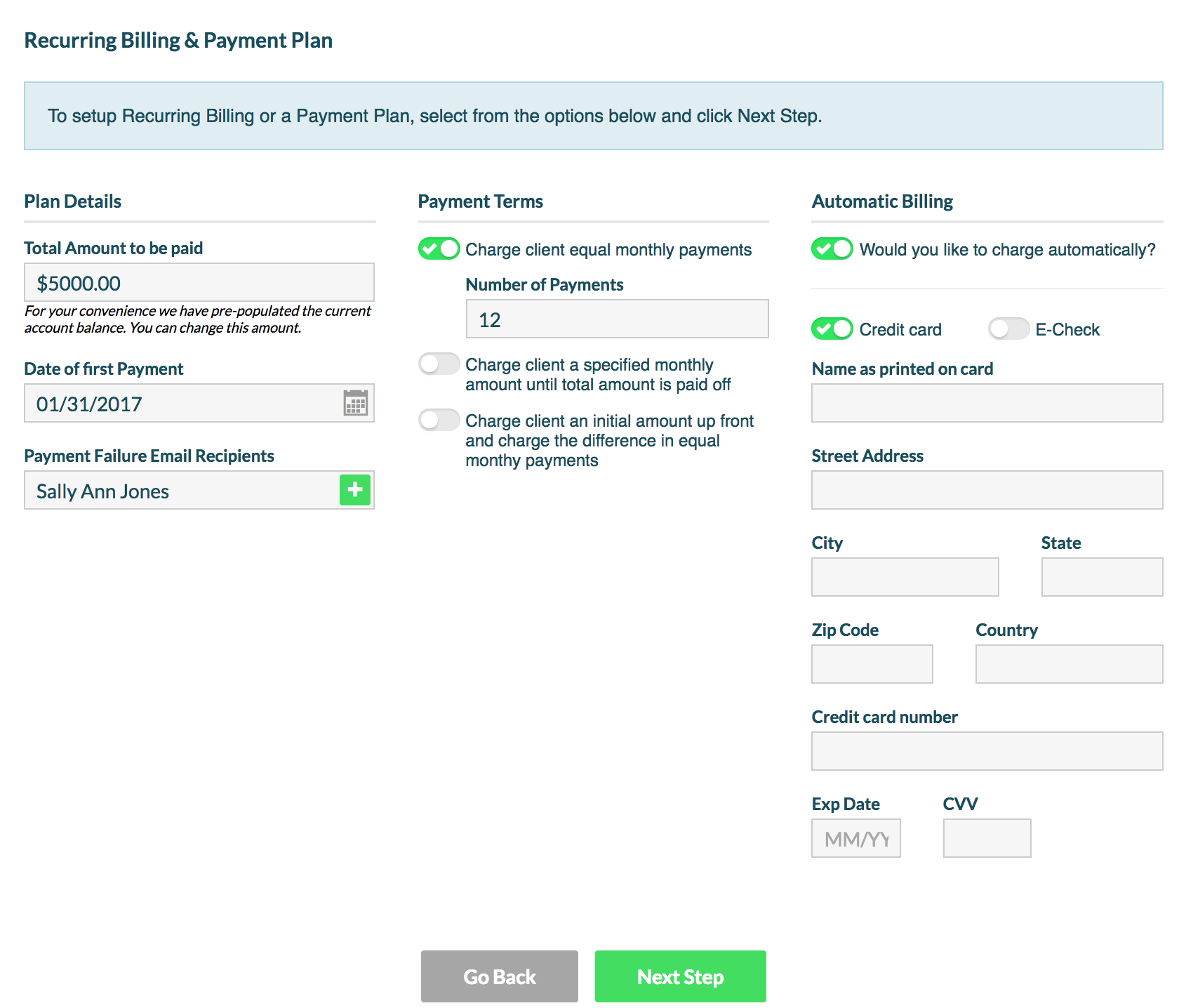

An even better way to ensure that you get paid is to use Rocket Matter’s Payment Plans feature to automate charges to your client’s credit card or bank account. Once you have your client’s authorization to proceed with such a plan, Rocket Matter’s technology will automatically charge your client the amount you designate each month and then send an automatic payment confirmation via email. You can ask for a larger amount up front and split the rest over a specified number of payments. Or if your client says something like, “I can only afford fifty bucks each month,” you can set the payment plan to charge in fifty-dollar increments until the outstanding balance is paid off.

Payment plans can help get new cases in the door.

Many lawyers come across potential clients who want help and are willing to pay for their services but can’t fork over a large sum of money at once. Regardless which area of practice you’re in, you could have potential clients who may take the opportunity at getting your help if only they can pay you in a way that’s manageable and predictable.

Automating the process of collecting a monthly payment from clients makes it a bit easier to take on such cases. And when you using payment plans correctly, you can really increase your collections, cash flow, and firm growth.

Share post: